How do you achieve financial success? You use the time value of money!

Financially successful individuals understand this. Successful businesses understand this. Credit card companies definitely understand the time value of money but they use it against you.

So let’s develop your skills with an easy to understand explanation of the time value of money. With nothing more than the fingers on your hand, you will be able to calculate what a dollar saved today will be worth in 10, 20, 30, 40, 50 years.

Ready? Let’s get started…

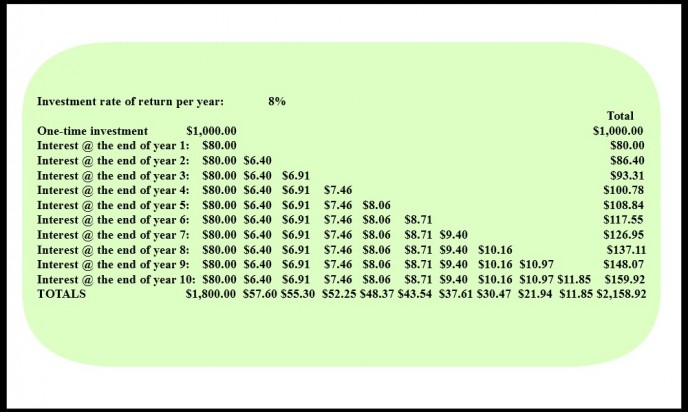

First Time Value of Money Truth: Money doubles every 10 years when invested at 8%

Proof:

Based on our schedule, you can see that $1,000 was invested at 8% rate of return per year. This means that someone is willing to pay you 8% per year to use your money. At the end of year 1, your money earned $80. The next year you earn another $80 plus $6.40 (8% on the first years $80). The next year you earn another $80 plus $6.40 on the first years $80 plus $6.40 on the second years $80 plus $.51 on the first years $6.40. And so on and so on for 10 years.

WOW! Your interest is now earning interest, and all you had to do was leave it allow (that is, DON’T spend it) As you can see every year you earn more and more interest, until at the end of the 10 years, your $1,000 has turned into $2,158.92.

Your money doubled in ten years. (MAGIC!)

Second Time Value of Money Truth: Over any given 10 year period, the stock market has averaged between 10% – 13% rate of return. Yes it goes up and down, but over a long period of time it will hit in that 10% – 13% range. The KEY here is to think long-term.

Therefore, an 8% rate of return is reasonable.

Third Time Value of Money Truth: Based on the information above you can now calculate what your money will be worth 10, 20, 30, 40, 50 years from now.

Here’s how: Let’s say you are 18 and you invest $1 at 8%. Just take your hand and do the finger math!

As you can see, in 10 years you will have $2,

As you can see, in 10 years you will have $2,

20 years – $4,

30 years – $8,

40 years – $16,

50 years – $32.

So, by the time you are 68 your $1 investment has grown to $32.

Now just add zeros:

$100 ~ 10 yrs – $200, 20 yrs – $400, 30 yrs – $800, 40 yrs – $1,600, 50 yrs – $3,200

$1,000 ~ 10 yrs – $2,000, 20 yrs – $4,000, 30 yrs – $8,000, 40 yrs – $16,000, 50 yrs – $32,000

$10,000 ~ 10 yrs – $20,000, 20 yrs – $40,000, 30 yrs – $80,000, 40 yrs – $160,000,

50 yrs – $320,000

$100,000 ~ 10 yrs – $200,000, 20 yrs – $400,000, 30 yrs – $800,000, 40 yrs – $1,600,000,

50 yrs – $3,200,000

You can now do this with all kinds of numbers. Let’s say you earn $50 a month babysitting, and you save it for twelve months. That would be $600. Now using your fingers just double it!

$600 ~ 10 yrs – $1,200, 20 yrs – $2,400, 30 yrs – $4,800, 40 yrs – $9,600, 50 yrs – $19,200

Let’s say you do that for every year you are in high school. So every $600 would equal $19,200 in 50 yrs. That would be $76,800 for just four years of saving. If you saved $600 every year for 50 years that would be worth $371,800. (Just for fun $600 per year is less than two-cents a day. So next time you see those pennies on the ground, pick them up, and invest them!)

You can see how money GROWS AND GROWS when you SAVE and INVEST.

A few notes (you know just for fun):

$ Have a plan (Budget Your Money)

$ Have a plan (Budget Your Money)

$ Start to save and invest early and often

$ Slow and Steady wins the race

$ Zero times any number is Zero ($0 * 1,000,000 = $0). So SAVING A LITTLE EVERYTIME IS BETTER THAN NOT SAVING ANYTHING.

$ If your money earns 10% it will double every 7 years. (So in 50 years your money will double 7 times ~ 50 years/7 years = 7 years) You can play around with that!

$ People of all ages can use this finger math. But as you can see, if you are starting your saving and investing later in life, you will have to save more since you may only have 20 – 40 years to accumulate interest.

This is dedicated to:

My beautiful friend Kim and her daughter Alex. No need to worry. Form a plan and stick to it. Yours may not be a typical career path but with flexible and marketable skills, and long-term investments generating interest, you will have a wealthy life.

And

My good friend William G. Marshall Founder of TEEN Millionaire Movement. Check him out on Facebook: TEEN Millionaire Movement. He LOVES to teach the MAGIC of the Time Value of Money.

~Develop Your Skills ~

| Money Habits and A New Year | Money and Love | ||

| Money Habits and A New Year | |||

| Money and Love |

The Open Gate

[…] a tax refund as a good thing, it really is a waste of your money. In the February 5th TOG Blog ~ Time Value of Money ~ we talked about the time value of money and financial success. When you receive a refund that […]