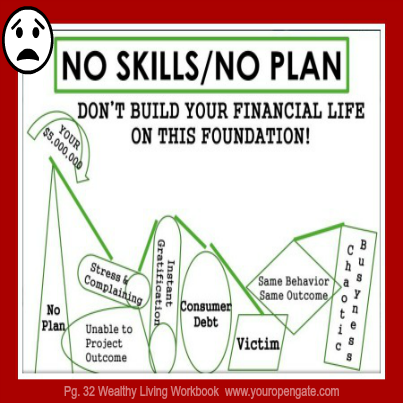

8 Easy Steps to Money Worries

The details of the stories vary, but the underlying traits, behaviors, and beliefs do not.

– It starts with having NO PLAN for your $

– This leads to being UNABLE to PROJECT OUTCOMES

Here is an example: Your insurance is due every six months but there is a panic when the bill arrives. No money to pay the bill. The car needs new tires; the refrigerator stops working; Christmas arrives every December…This panic and uncertainty creates STRESS

– This leads to COMPLAINING and other bad habits

– INSTANT GRATIFICATION is a destructive habit used to sooth STRESS. It may sound like this ‘I work hard’, ‘I deserve it’

– INSTANT GRATIFICATION leads to CONSUMER DEBT

– CONSUMER DEBT consumes your $. Ask yourself this, ‘Would I invite cancer into my life?’. CONSUMER DEBT is FINANCIAL CANCER.

Here is an example: Go out and charge a nice dinner…because you ‘deserve it’. Your body will process that meal within 24 hours, however, making minimum payments, it will take you approximately 6 months to pay for it and will cost you an extra 12% (that is approximately the same amount of $ as a lunch out or 5 coffees)!

– Chronic CONSUMER DEBT leads to a VICTIM Mentality.

– A VICTIM Mentality is wanting things to be different but focusing only on the current situation. Every time one of those bills shows up, you feel guilty about the past and worry about the future and use your money in the present to pay. It feels like it is being done to you: ‘Poor me, I can’t catch a break, I have the worst luck.’ The cycle continues until you are officially broken. Broken people perform the SAME BEHAVIOR and expect different outcomes.

– SAME BEHAVIOR will result in the SAME OUTCOME.

– This leads to a very CHAOTIC life (unable to project outcomes) and full of BUSYNESS (a jam-packed schedule that never really produces anything).

– This person is always too busy to change, to learn something new, or to make time to create a plan.

NO SKILLS, NO PLAN = MONEY WORRIES

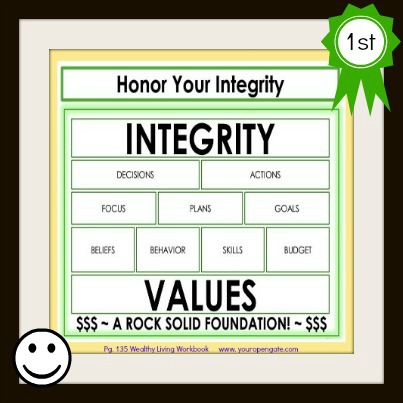

The opposite of MONEY WORRIES is a

ROCK SOLID FINANCIAL FOUNDATION

$ You start with Your VALUES.

Example: I VALUE creating a financially fantastic life

$ Check in with yourself: ‘Are my BELIEFS in alignment with my VALUES?’

Example: ‘I VALUE creating a financially fantastic life’ becomes ‘I BELIEVE I am able to pay off my debt.’

$ Make sure your BELIEFS and BEHAVIORS are in alignment.

Example: ‘I BELIEVE I am able to pay off my debt’ becomes my BEHAVIOR: ‘All extra money goes toward debt reduction.’ So it might sound like this: ‘Hey, want to go out to dinner tonight?’ Your answer: ‘I am paying off my debt but I would love to hang out! Come over and we can watch a movie.’

$ You have DEVELOPED YOUR SKILLS and you have a BUDGET. You TRACK your money and RECONCILE to your BUDGET how you are spending your money.

Example: Using your SKILLS – you have a BUDGET – turns into HONORING YOUR INTEGRITY: You stick to the BUDGET and you RECONCILE how you spend your money to your BUDGET.

$ All your FOCUS, PLANS, GOALS, DECISIONS, and ACTIONS come back to your VALUES. This is HONORING YOUR INTEGRITY.

No more Money Worries ~ it is just that simple, and if you are just getting started, it will be just that challenging.

Why not end your Money Worries today and start to build your ROCK SOLID FINANCIAL FOUNDATION?

| Cute Puppies and Kittens ~ Cost Money | Money Truth – Financial Gravity | ||

| Cute Puppies and Kittens ~ Cost Money | |||

| Money Truth – Financial Gravity |